How To Use DeFi Pulse

The Decentralized Finance market is one of the fastest growing industries in the world of financial technologies and blockchain-based solutions. The services on offer on the DeFi market provide users with intermediary-free access to a wide range of facilities, such as lending, peer-to-peer interactions, transfers at low commissions, purchase and sale transactions, and much more. Considering the underlying blockchain layer that facilitates these operations, it is easy to imagine the amount of information being transmitted across various chains in the DeFi space.

When investors start looking for assets to buy for their portfolios as both long and short term additions, they must have access to a range of various metrics that would allow them to make adequate, weighted and informed decisions about the assets on offer. This is called technical and fundamental analysis. In the traditional financial world, such data is provided by indices, such as the S&P, the Dow Jones and others that specialize in analyzing the financial and other related metrics of companies. But when it comes to the decentralized environment, the situation becomes a bit trickier, since the amount of fraud in both the DeFi and the cryptocurrency markets is rampant.

The DeFi sector is known to have been subject to numerous hacker attacks and plenty of fraud on the part of projects has been taking place. An example is the most recent scandal with the Squid cryptocurrency that led to the loss of over five million dollars of investors’ money after the founders ran off with the funds and closed the project. These instances cast a long and dark shadow over DeFi and give investors sufficient grounds to doubt the metrics they see. Though immutable and fraud-free on a technical basis, the fundamentals of project analysis can be falsified on the team’s side, but not on the blockchain side.

This is where the need for dedicated, highly specialized and professional analytical, ranking and tracking services comes in. Such services scour the blockchain networks on the web and collect data on listed projects in real-time, analyzing their key metrics and providing reliable, accurate and up-to-date information on the performance of Decentralized Finance and other projects. One of the most popular and reliable services in this domain is DeFi Pulse. In this DeFi Pulse review, we will make an overview of how to use DeFi Pulse, what is DeFi Pulse in essence, and what other services it can provide.

What is DeFi Pulse?

At its core, DeFi Pulse is an analytical service that gives users access to open, unbiased and real-time information on the market ranking, capitalization, key metrics, analysis and other data of protocols and projects operating in the decentralized finance market. The service keeps track of various data streams aggregated from blockchain explorers and provides a reliable source of information on the total value locked in protocol smart contracts. The service provides information on the most popular protocols listed on it and offers a number of additional functions, such as newsletters that rely on the best sources of DeFi market data. Such a list of options gives users of DeFi Pulse the opportunity to tap into market data and identify potential projects for investment while receiving a full-round overview of the DeFi space.

DeFi Pulse is also the biggest resource related to anything in the DeFi space, as it provides reliable and accurate data on the most popular projects. Such information is vital to maintain a clear and transparent view of the market as a whole. Naturally, the largest share of all protocols on DeFi Pulse is Ethereum network based, meaning that the service relies on blockchain explorers from that source. In addition, it provides a good source of insight into possible market movements and the performance of various projects based on the latest dynamics in DeFi.

In essence, DeFi Pulse is more of an aggregator resource that acts as analogue of Coinmarketcap for the DeFi space, meaning that it is invaluable as a source of information that everyone in the market relies on. But apart from offering simple data streams and real-time analytics, DeFi Pulse also offers a host of other functions, such as educational material and tips on how to buy on Uniswap, how Uniswap works, and many other topics of interest to both novice and experienced investors and market participants.

How does DeFi Pulse Work?

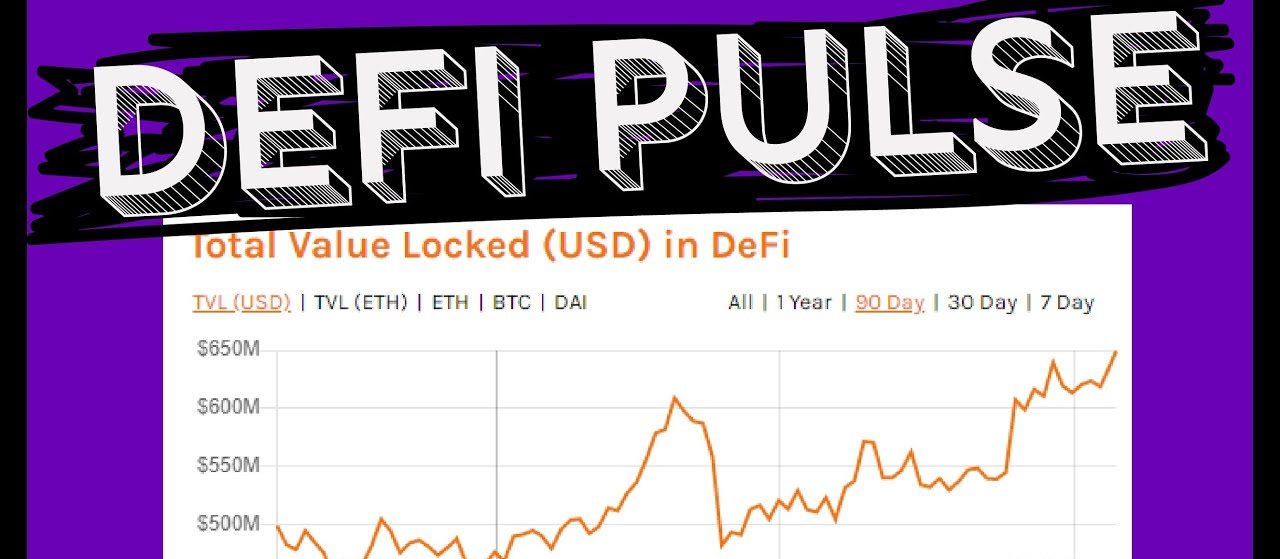

The DeFi market is based on a key metric called the Total Value Locked. It represents the amount of funds currently locked on smart contracts in various DeFi protocols. The DeFi Pulse website keeps track of this value to create a reliable estimate of the total capitalization of the DeFi market at large. As such, the first element on the DeFi Pulse website is the Total Value Locked graph that displays the total value of funds locked across DeFi protocols.

Apart from offering a clear graph of the TVL, DeFi Pulse also gives functionality to it, allowing users to adjust the time frames of overview and two other data metrics. The second is the X dominance factor, which stands for the positioning of a certain protocol on the market based on the liquidity it has locked on its smart contracts. The third is the DeFi Pulse Index – a special function that is based on the capitalization-weighted index tracking the performance of protocols and various assets across the entire decentralized finance market.

After the graph, the second important data source DeFi Pulse offers is the ranking – an in-depth insight into the positioning of various DeFi protocols based on a number of metrics. Once the corresponding page on the DeFi Pulse website is opened, users will see a ranking of projects and protocols based on their liquidity locked in smart contracts. The list also provides such information as the name of the protocol, their underlying blockchain, the category of services they are working in, the amount of funds locked, as well as the latest changes over the last 24 hours.

In general, the DeFi Pulse website provides a good overview of the market as a whole,iving an all-in-one frame snapshot of the state of DeFi. Experienced investors will be able to gauge the health and condition of the market based on the amount of TVL, as well as the performance of top projects, which often act as litmus tests for the whole market’s dynam gics.

How to start using DeFi Pulse?

The DeFi Pulse website is extremely intuitive and easy to use, given that all of the key metrics are provided on a single page that displays the main data on top-performing projects. All users need to do is go to the DeFi Pulse website and start reading the data, selecting categories of interest. Naturally, a certain amount of experience and knowledge will be needed to properly understand the graphs and make sense of the metrics.

Read more about DeFi Influencers Marketing

Benefits of DeFi Pulse

The benefits of such services as DeFi Pulse cannot be underestimated, since they provide vital information on the performance of top market protocols and give tangible values to the market. Such websites act as invaluable evaluators of market data and aggregators of key metrics that serve as support for investors to make decisions. In addition, sites like DeFi Pulse give researchers, project developers and market analysts invaluable sources of historical market data for evaluating various protocols and their viability as concepts.

Conclusion

The DeFi Pulse website is a service that keeps track of decentralized market performance and gives market participants access to important market data that can be used for evaluating the condition of top protocols across DeFi. The ease of use and versatility of the graphs presented on the resource makes it accessible to novice users, while experienced investors will find it a reliable source of vital information for evaluating potential investment projections.

Also you can read about DeFi Marketing